Contribution margin per unit formula

The contribution margin per unit is the dollar amount in which the selling price of a product exceeds its variable. Contribution Margin Per Unit Formula MT_Leroy402 September 11 2022.

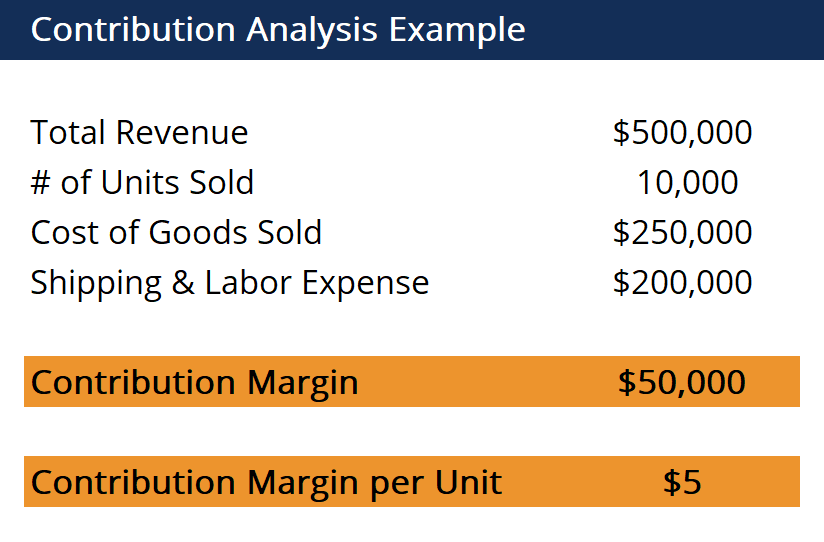

Contribution Analysis Formula Example How To Calculate

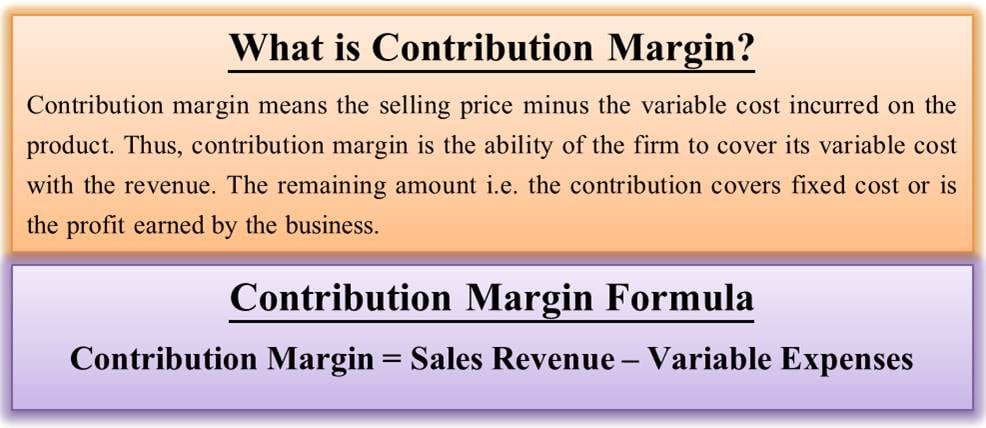

Contribution Margin formula is used to find out how much profit the company makes on each sale.

. For example a company sells 10000 shoes for total revenue of 500000 with a. The formula for contribution margin dollars-per-unit is. Total revenue variable costs of units sold.

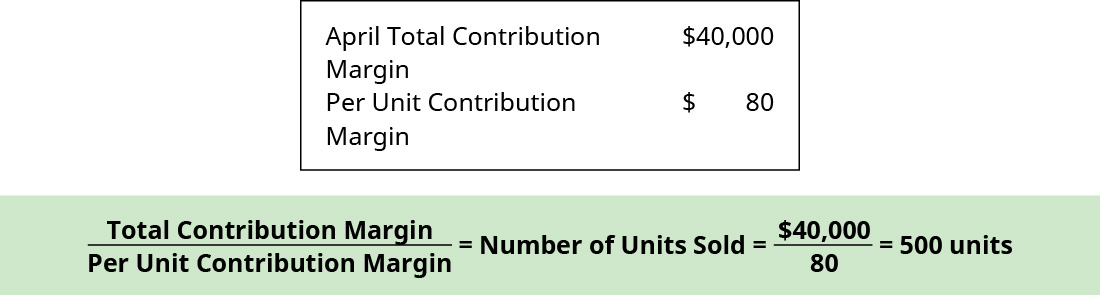

But anyway lets go back to our bakery and see what those 80 per cake mean. Total cost Number of units Unit cost 15000 10000 150 Definition. As a result the contribution margin for.

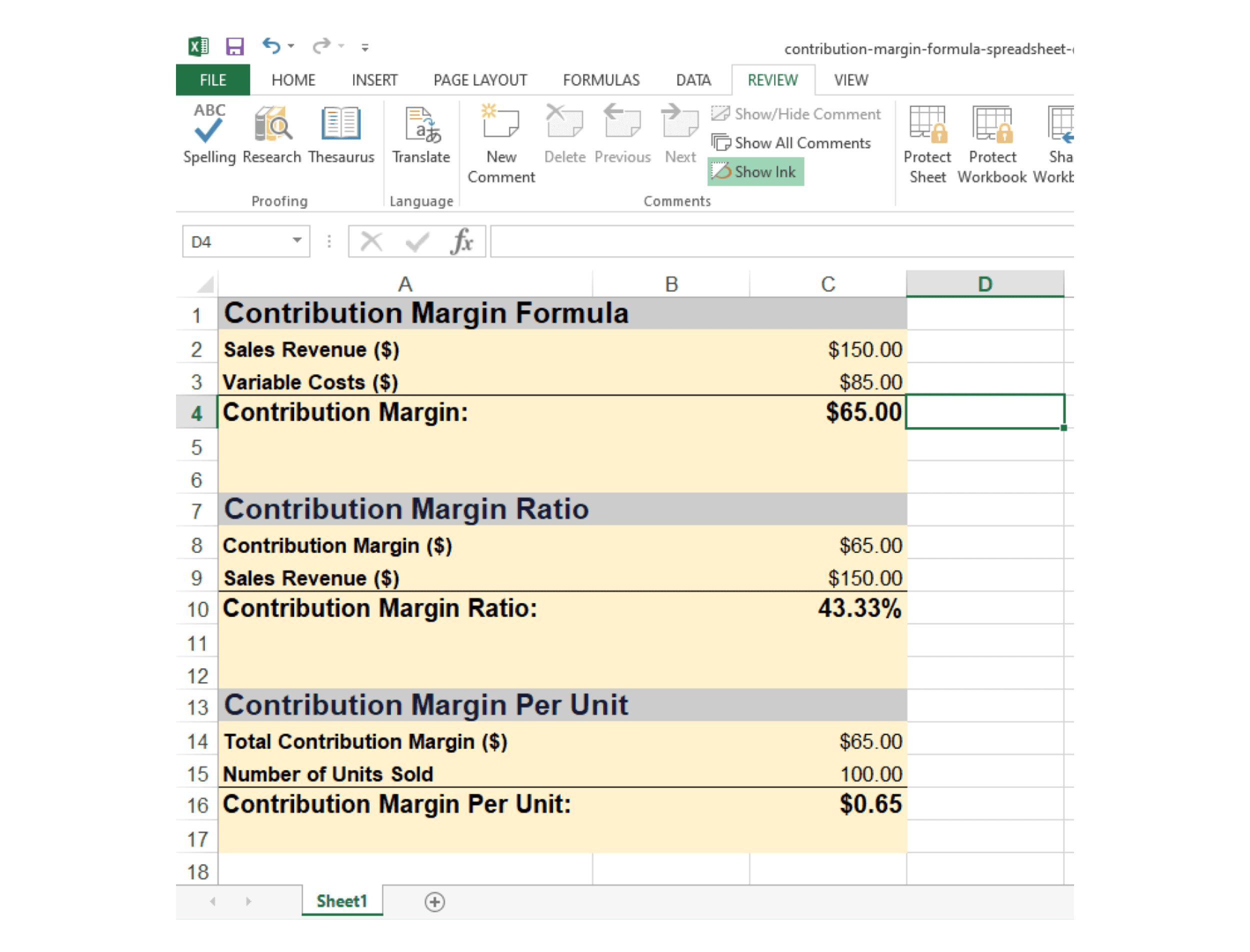

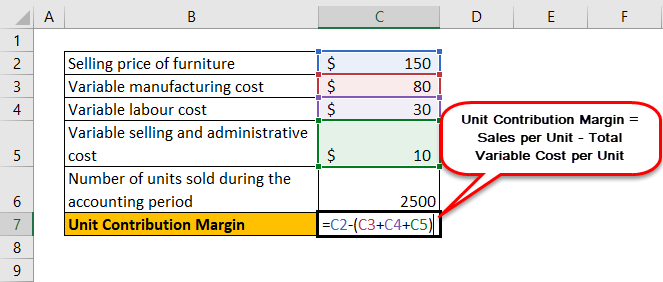

The selling price per unit is 100 incurring variable manufacturing costs of 30 and variable sellingadministrative expenses of 10. The formula for contribution margin dollars-per-unit is. The formula for calculating the planned ratio is the production cost.

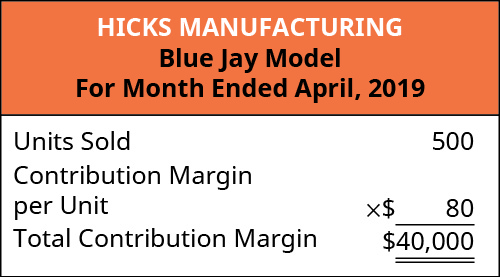

The 80 contribution margin means that whenever we sell a cake we get a margin. Example of Contribution per Unit. Accordingly the contribution margin per unit.

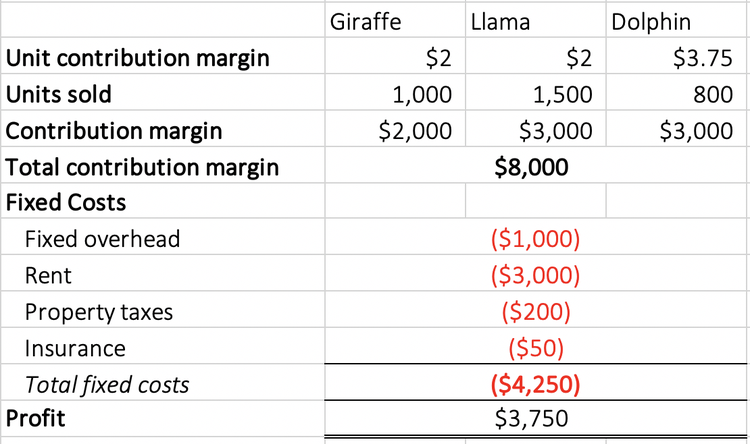

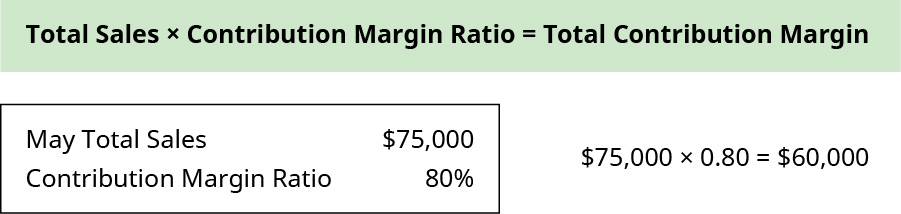

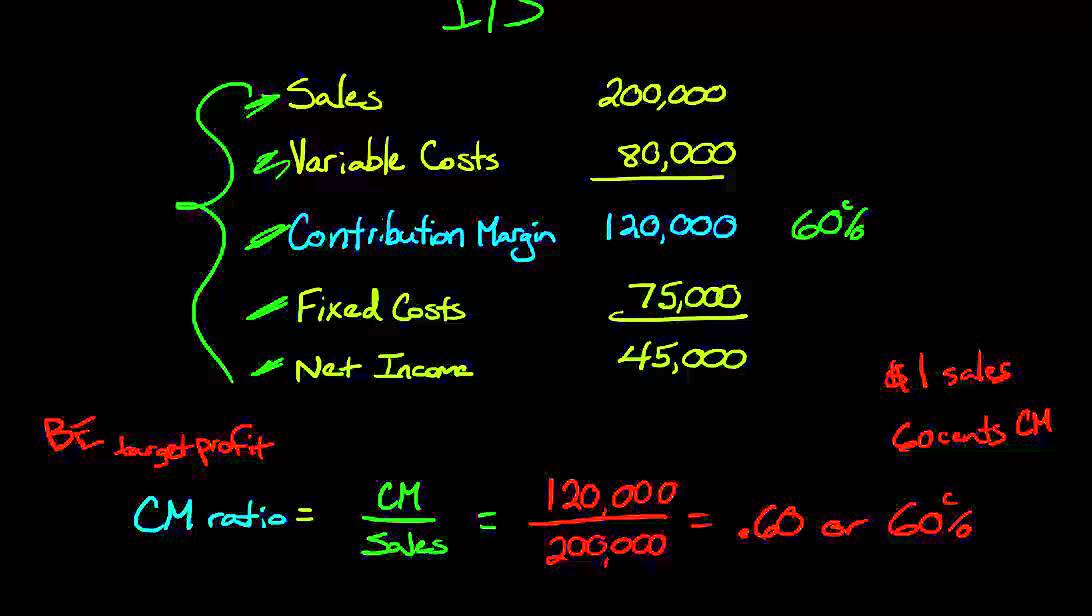

This formula shows how much each unit sold contributes to fixed. The contribution margin percentage also known as the contribution margin or the contribution margin ratio is a margin stated on a gross or per-unit basis. Contribution per unit Total revenues Total variable costs Total units.

It is useful for establishing the minimum price at which to sell a unit which is the variable cost. With the above information Green Co. Total revenue variable costs of units sold.

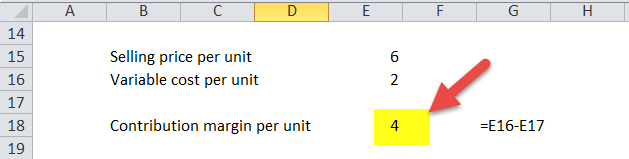

The contribution margin ratio per unit formula would be Selling price per unit Variable cost per unit. The phrase contribution margin can also. The contribution margin per unit should never be less than zero as if the contribution margin becomes less than zero it will result in the loss while selling the product.

Contribution Margin Per Unit. The contribution margin is the. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.

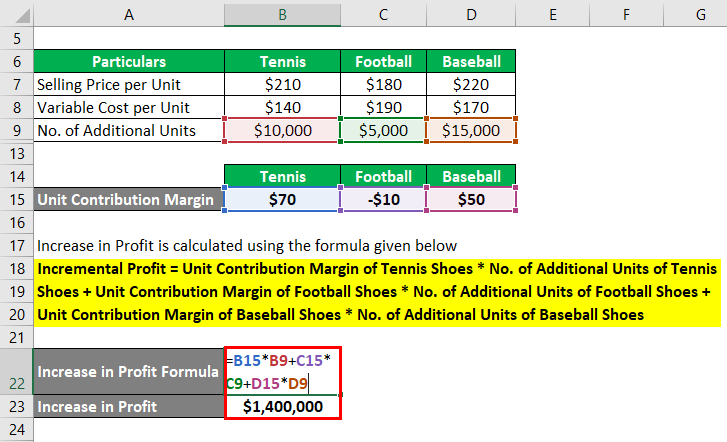

The contribution would be Margin per Unit Number of Units Sold. For the calculation we use the formula. For example a company sells 10000 shoes for total revenue of.

This margin analysis can apply to the sale of either goods or services. Calculates the contribution per unit as follows. Its also common for management to calculate the contribution margin on a per unit basis.

The purchase price transport costs in monetary terms duty in monetary terms. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products. Cost Volume Profit Analysis Cost Accounting Analysis Contribution Margin Recipe Cost Calculator.

The Contribution Margin Formula is. As an example of contribution per unit ABC International has generated 20000 of revenues in the most recent reporting period from sales. Of units that need to be sold in.

How To Calculate The Unit Contribution Margin

Contribution Margin Ratio Revenue After Variable Costs

Contribution Margin What It Is And How To Calculate It

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Unit Contribution Margin How To Calculate Unit Contribution Margin

Contribution Margin Per Unit Possibly The Most Important Number In Your Business Clever Product Development

Contribution Margin Explained In 200 Words How To Calculate It Cristian A De Nardo

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Meaning Formula How To Calculate

7 1 Exploring Contribution Margin Financial And Managerial Accounting

8 Managerial Accounting Formulas Equations For Accountants Zoho Books

Contribution Margin Formula With Calculator

What Is Contribution Margin How To Find Formula Example Efm

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Contribution Margin Ratio Youtube

Contribution Margin Ratio Formula Per Unit Example Calculation

Unit Contribution Margin Meaning Formula How To Calculate